Stock Trading Fundamentals Explained

Wiki Article

The Ultimate Guide To Stock Trading

Table of ContentsThe Best Strategy To Use For Stock TradingAbout Stock TradingStock Trading - QuestionsGet This Report about Stock Trading

The fact is that investing in the securities market brings threat, however when come close to in a disciplined manner, it is among one of the most reliable means to accumulate one's internet well worth. While the typical individual keeps many of their total assets in their residence, the wealthy and also extremely rich usually have most of their wealth spent in supplies.Possessing stock indicates that a investor possesses a slice of the company equivalent to the variety of shares held as a proportion of the firm's total amount exceptional shares. A private or entity that has 100,000 shares of a company with one million impressive shares would certainly have a 10% possession stake in it.

Stocks are additionally called shares or a firm's equity. The primary distinction in between the two is that usual shares typically carry ballot rights that make it possible for the typical investor to have a say in business conferences and also political elections, while favored shares usually do not have voting civil liberties.

Ordinary shares can be further categorized in regards to their ballot legal rights. While the standard premise of common shares is that they ought to have equivalent voting rightsone vote per share heldsome companies have dual or several courses of supply with different ballot civil liberties connected to each course. In such a dual-class framework, Course A shares might have 10 votes per share, while Class B shares might just have one ballot per share.

The Ultimate Guide To Stock Trading

This alters the condition of the company from a personal company whose shares are held by a couple of investors to a publicly-traded company whose shares will be held by various members of the public. The IPO also uses early capitalists in the company a chance to squander part of their risk, typically enjoying extremely handsome incentives in the procedure./GettyImages-699097867-7277b42432f6473c9844a656d0014712.jpg)

Companies may take part in supply buybacks or provide new shares yet these are not day-to-day procedures and also usually happen beyond the structure of an exchange. When you acquire a share of supply on the stock market, you are not getting it from the business, you are buying it from some other existing shareholder.

Not known Facts About Stock Trading

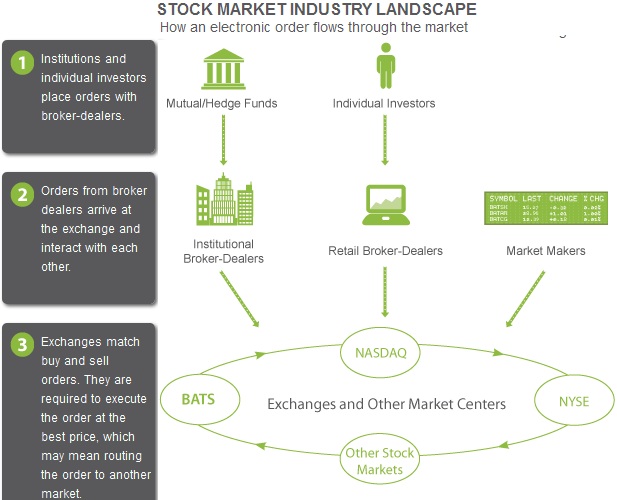

Today, there are numerous stock market in the united state and throughout the world, a lot of which are linked try this web-site with each other electronically. This in turn implies markets are more reliable as well as a lot more liquid. There likewise exists a number of loosely regulated over the counter (OTC) exchanges, which may also be referred to as bulletin board system (OTCBB).Larger exchanges may need that a company has actually functioned for a certain quantity of time prior to being noted and also that it fulfills specific conditions pertaining to business worth and profitability. In most established nations, stock market are self-regulatory more information organizations (SROs), non-governmental organizations that have the power to develop as well as apply industry laws and standards.

Examples of such SRO's in the U.S. include specific supply exchanges, along with the National Organization of Securities Dealers (NASD) and also the Financial Industry Regulatory Authority (FINRA). The costs of shares on a supply market can be embeded in a number of ways. The most common way is with an public auction procedure where purchasers and vendors place bids and supplies to purchase or sell.

The overall market is made up of millions of financiers as well as investors, that might have varying ideas about the value of a particular supply and also therefore the rate at which they are ready to buy or market it. The thousands of purchases that occur as these financiers and traders convert their objectives to activities by purchasing and/or marketing a supply reason minute-by-minute revolutions in it over the training course of a trading day.

The smart Trick of Stock Trading That Nobody is Talking About

For the average individual to obtain access to these exchanges, they would need a stockbroker. This financier acts as the middleman in between the purchaser as well as the vendor.Since of the immutable laws of supply and also demand, if there are more purchasers for a certain stock than there are vendors of check that it, the stock price will certainly trend up. Conversely, if there are more sellers of the stock than customers, the price will trend down.

If customers exceed sellers, they might agree to raise their bids in order to obtain the supply. Vendors will, consequently, ask greater costs for it, ratcheting the cost up. If sellers exceed customers, they may agree to accept lower deals for the supply, while purchasers will certainly likewise lower their proposals, successfully forcing the cost down.

Report this wiki page